Apply Now

Required Documents for GST Registration

Required Documents for GST Registration: Make sure you have the documents mentioned below ready for a smooth registration process:

- For Companies:

- Certificate of Incorporation

- PAN card of the company

- Articles of Association (AOA)

- Memorandum of Association (MOA)

- Board Resolution

- Identity and address proof of directors

● For LLPs:

● PAN Card of LLP

● LLP Agreement

● Partners’ names and address proof

- For Individuals/Proprietorships:

- PAN Card

- Address proof of the proprietor

- Any 2 of the following as address proof:

- Telephone or Electricity Bill

- Driving License

- Bank Account Statement

- Ration Card

- Passport

- Voter Identity Card

- Aadhar Card

Who Should Register for GST?

Who Can Register

Individual/Proprietorship Firm

Partnership Firm

Private Limited/LLP/NGO

Mandatory For

Turnover Criteria

Any businesses which have a turnover of above 40 lakhs (Rs 10 Lakhs for North-Eastern states, J & K, Himachal Pradesh and Uttarakhand), Rs 20 lakhs in case of services.

E-commerce operator

Person who connects through e-commerce business (such as Amazon or Flipkart), should register for GST from the beginning only.

Casual Taxpayer

If you supply goods or services in events/exhibition & you don’t have a permanent place of business, you need to get online GST Registration. The validity of causal GST Registration is 90 days

Sales/Service provide to other state (Inter State)

One should register under GST if any supplier of goods or service provider involved in any other state.

Involved In Online Information

Person supplying online information and database access other than a registered taxable person

NRI Exporters & Importers

Any NRI person or company supplying goods or services in India need to register GST regardless of turnover.

Time

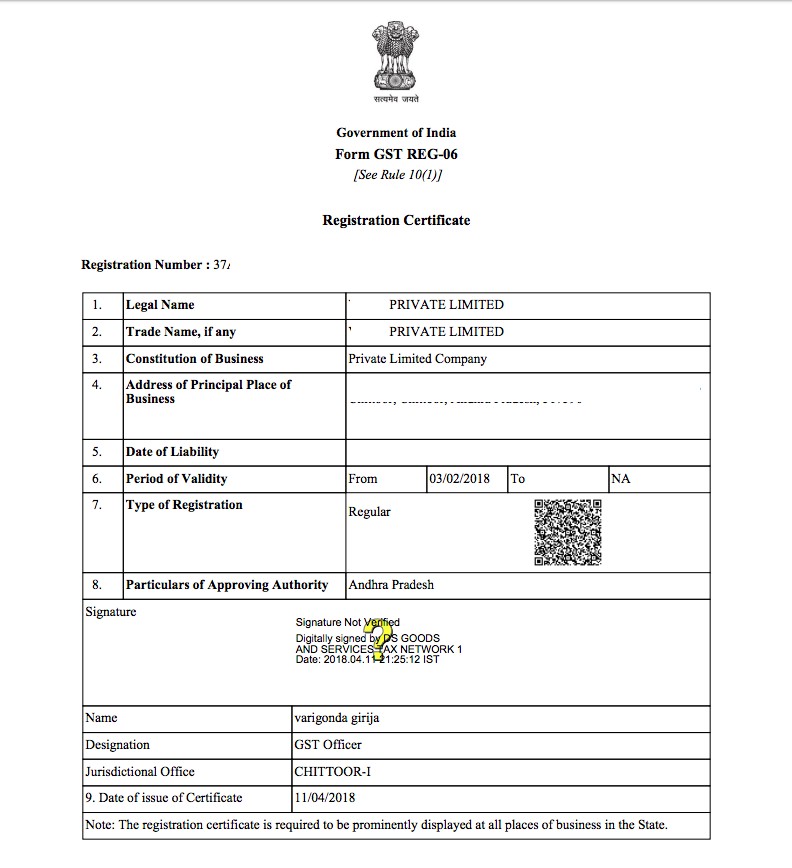

Get GST Registration Certificate and Number within 1-5 days

Get GST Registration Certificate and Number within 1-5 days

Get GST Registration Certificate and Number within 1-5 days

GST Registration Packages

Professional Fees

Start Up

Rs.799

Application filing for GSTIN

Generate ARN & TRN number

Call, Chat, Email Support

Personally assigned GST Expert

Consultation Available in 3 Languages including Englis

Basic

Rs.2499

GST Registration absolutely FREE

GST Return Filing for 3 Months

Call, Chat, Email Support

Personally assigned GST Expert

Consultation Available in 3 Languages including English

Standard

Rs.4999

GST Registration absolutely FREE

GST Return Filing for 6 Months

Call, Chat, Email Support

Personally assigned GST Expert

Consultation Available in 3 Languages including English

Premium

Rs.7999

GST Registration absolutely FREE

GST Return Filing for 12 Months

Call, Chat, Email Support

Personally assigned GST Expert

Consultation Available in 3 Languages including English

FAQ

Yes, you can make a voluntary register for GST even if your turnover is below the GST threshold. This can be advantageous for claiming input tax credits, engaging in interstate commerce and enhancing your business credibility.

Failing to register for GST on time can result in late fees and interest charges. It is important to comply with registration deadlines to avoid these financial penalties and ensure adherence to tax laws.

The effective date of GST registration is the date from which you are liable to pay GST, whereas the date of registration is when you are officially registered under GST. Recognizing this distinction is crucial for determining when your GST obligations start.

The GST Annual Return is a comprehensive summary of a taxpayer’s financial activities over a fiscal year, including sales, purchases and taxes paid. It offers an overview of the taxpayer’s GST transactions.

The HSN Code or Harmonized System of Nomenclature, is an internationally standardized coding system for classifying goods. It facilitates the identification of products for tax and regulatory purposes, aiding smooth trade operations.

The full form of SAC Code is ‘Service Accounting Code.’ It is a classification system for services under GST, promoting uniform taxation and simplifying compliance for service providers.

Yes, a salaried person can apply for GST registration if they are involved in business activities outside their employment. Registration becomes mandatory if the aggregate turnover exceeds the prescribed threshold.

An E-way Bill is a document that helps move goods worth over a specified value between different states. It provides detailed information about the consignment to ensure tax compliance and facilitate the smooth transportation of goods.

If your GSTIN was canceled without filing the final return, promptly file the pending return to avoid penalties and compliance issues.